What Is The Limit Of Earned Money That I Dont Need To Reporte In Nevada

Note: The Social Security earnings limit changes each year. The most electric current version of this article uses numbers for 2022.

At ane of my first speaking engagements, I heard a bang-up story from one of the attendees. Her experience provides us with i of the best examples I've ever heard of how much the Social Security income limit can grab you by surprise.

A few years earlier, she'd been at her span club when the topic turned to Social Security. Every bit she and the other card players chatted nigh the all-time way to leverage Social Security Benefits, the consensus around the tabular array seemed to be that filing at 62 was the smartest thing to exercise.

This lady, trusting the communication of some of her closest friends, did just that: She filed for benefits as shortly as she turned 62.

She and so told me she'd e'er wanted to purchase a brand-new Toyota Camry. She figured that, once she started receiving Social Security income, it would be the perfect fourth dimension to buy the motorcar. She was still working, which meant her Social Security check would be extra income.

As she told the story to me, she bought the car and took out a automobile loan to do it. She planned to repay the loan using some of the income she expected to receive from her Social Security benefits since she filed for them.

Imagine her surprise, then, when a nasty letter from Social Security Administration showed upward in her mailbox. The alphabetic character claimed she had been paid benefits that she was not eligible for!

The Social Security Administration not but asked her to pay the benefits back, but also informed her that future benefits would exist suspended due to her income.

At present she had a new automobile and a motorcar loan, without the Social Security benefits she planned to apply to handle that monthly payment. What happened here?

Something that surprises more than than just the poor Camry owner who approached me that twenty-four hour period: the Social Security income limit.

What Is the Social Security Income Limit?

The earnings limit is also known as the income limit, or the earnings exam. The official term is "earnings test," merely income limit and earnings limit are the terms that you'll hear well-nigh often.

For our purposes, know that all these terms mean the aforementioned thing — and there are iv quick facts about the Social Security income limit that you should know earlier we bound all the style into explaining the examination or limit:

- Be enlightened that we are talking about Social Security income limits for retirement benefits, not inability or SSI.

- The earnings limit on Social Security is not the same every bit income taxes on Social Security . Don't get the two confused!

- The earnings limit does non employ if y'all file for benefits at your full retirement age or beyond. These limits just use to those who begin taking Social Security benefits before reaching full retirement age.

- The earnings limit is an individual limit. If yous are still working, and your spouse is cartoon Social Security, your earnings volition not count towards their income limit .

Why We Have An Earnings Limit

Not long ago, a viewer on my YouTube aqueduct asked me to give her a expert reason why we have the Social Security earnings limit. The comments that followed showed how many viewers shared the belief that the earnings limit is unfair and should be eliminated.

In my response, I explained that the rationale behind the entire programme of Social Security was to create a safe internet. The original intent of the Social security plan was non to supplement retirement income, but to go on the elderly (about of whom lost any potential long-term wealth in the Great Low) out of poverty.

I also added that today's earnings limit is relatively generous compared to where the Social Security earnings limit began. The original Economic Security Bill (which is what the Social Security Human activity was originally chosen) President Roosevelt sent to Congress featured a very restrictive earnings limit.

That bill stated, "No person shall receive such old-historic period annuity unless . . . He is not employed past another in a gainful occupation."

Whoa! This means that if you had even a single dollar in wages from a task, you could not collect a Social Security do good at all.

(If y'all're curious, you can read more almost the history of the Social Security earnings limit hither.)

Thankfully, the system we have in place today allows for individuals to have some earnings from work while they are receiving a Social Security benefit.

However, information technology'south very important to stay informed on the dollar amount of this limit because it changes every year.

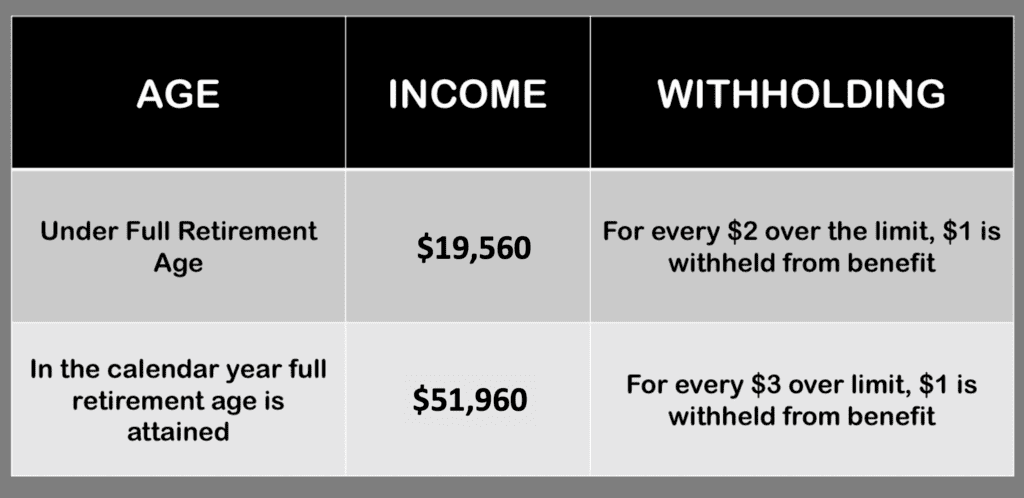

For 2022, the Social Security earnings limit is $19,560. For every $two you lot exceed that limit, $one will be withheld in benefits.

The exception to this dollar limit is in the calendar yr that y'all will achieve full retirement age. For the menstruation betwixt January 1 and the month y'all attain full retirement historic period, the income limit increases to $51,960 (for 2022) without a reduction in benefits. For every $3 y'all exceed that limit, $ane will exist withheld in benefits.

This means that if you accept a birthday in July, you'll take a 6 month menstruation with an increased income limit before information technology'south dropped completely at your full retirement historic period. This increased limit and decreased withholding amount allow many individuals to retire at the beginning of the calendar year in which they reach full retirement age, rather than waiting until their actual birthdays.

Once more, once you reach full retirement historic period, at that place is no reduction in benefits regardless of your income level.

A Real-Life Instance of the Social Security Income Limit in Activity

To put these numbers into context, let's await at an instance of how this might piece of work in a real-life scenario:

Rosie is 64 years one-time. She started taking Social Security benefits equally before long as she turned 62. Based on her birth year, her total retirement age is 66.

Correct at present, Rosie is eligible for $20,000 in Social Security benefits per year. She also worked during the twelvemonth and fabricated $29,560 in wages.

The question we want to sympathise is, how much was Rosie's benefit reduced by working while on Social Security? To reply that, nosotros start need to calculate how much Rosie was over the Social Security earnings limit for her age.

In 2021, Rosie filed for Social Security; she received her first check in January of 2022. Throughout the yr she received $i,667 in benefits every month. Without knowing the rules, she also worked and earned $29,560 in wages.

With a Social Security earnings limit of $nineteen,560, she was over by $10,000:

$29,560 Full Wages – the Social Security Income Limit of $xix,560 = $ten,000 Income in Excess Of Limit

Considering this is a full agenda year during which Rosie is receiving benefits simply is non all the same full retirement age, the benefits reduction corporeality is $1 reduction for every $2 in excess wages. Since she was over the limit by $10,000, her benefits will exist reduced by $5,000.

The benefit reduction adding would announced as follows:

$10,000 Income in Backlog of Limit x 50% ($1 reduction for every $two over limit) equals a $v,000 Benefit Reduction

With a $5,000 benefits reduction for exceeding the income limits, Rosie'south $20,000 yearly Social Security do good will be reduced to a $15,000 do good for the year. In the following year she would attain her full retirement historic period and afterward her birthday, the limit would no longer apply.

How Does The Income Limit Impact Spousal, Survivor, or Children'south Benefits?

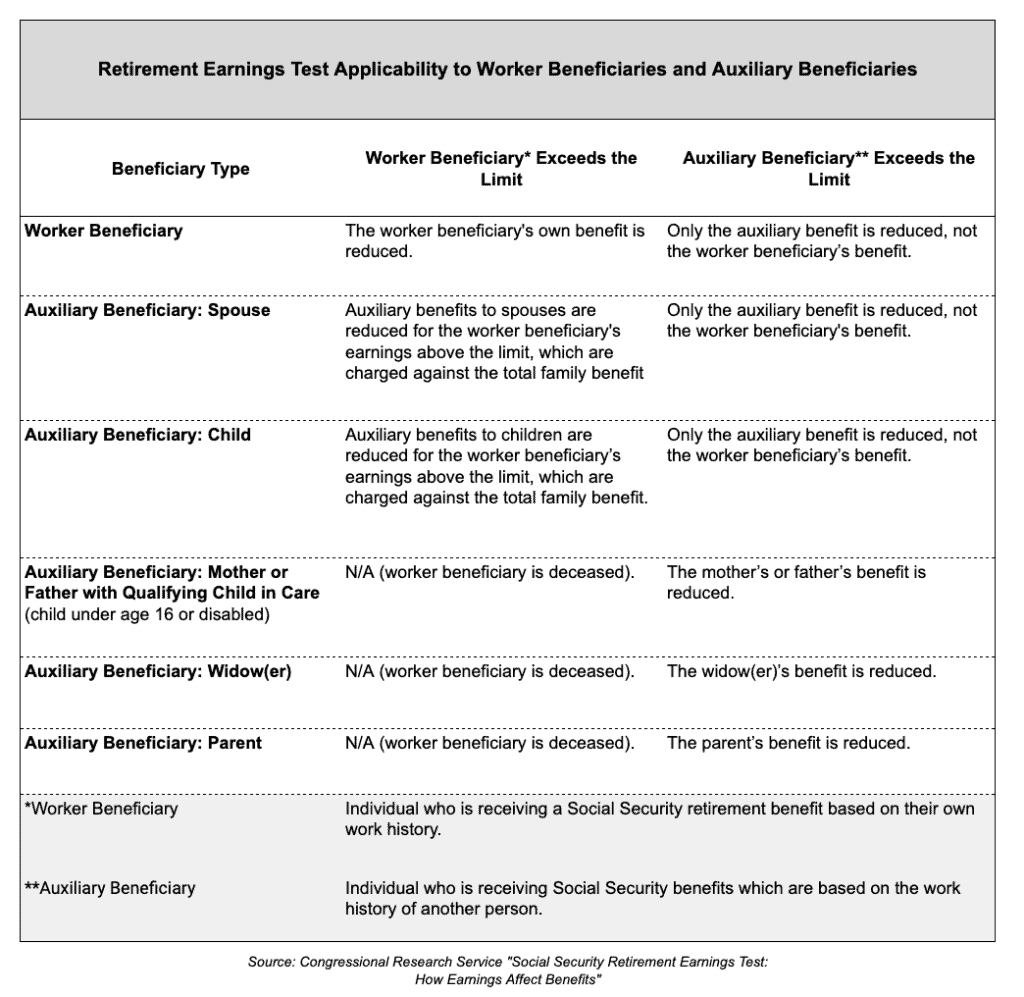

There are millions of individuals who receive benefits as an "auxiliary" of a retired or disabled worker. These auxiliary beneficiaries are also bailiwick to the same earnings test.

See the chart below for more than detail on how the limits are practical to each type of benefit.

Special Monthly Income Limit Rule for the Showtime Year (or, Your Grace Yr)

Many people who retire mid-year have already earned more income than the limit allows. This is why there is a special dominion where the earnings limit switches from an annual limit to a monthly limit. (These monthly limits are 1/12 of the almanac limit.)

This rule allows y'all to receive a check for whatsoever month you are considered "retired" by the SSA fifty-fifty if you take already exceeded the almanac earnings limit.

That sounds straightforward enough — but the interpretation of "retired" equally divers past the SSA can cause some defoliation. Here'southward what they hateful by this term:

You are retired if your monthly earnings are ane/12 of the annual limit ($1,630 for 2022) or less and you did not perform substantial services in self-employment.

Essentially, you are considered retired unless you make more the income limit. The dominion for the year yous reach full retirement historic period also applies when working with the monthly limit. In this calendar twelvemonth for 2021, the limit is $4,330 (one/12 of $51,960).

It's very of import to remember that in the twelvemonth following this first year, the monthly limit is no longer used and the earnings limit is based solely on your annual earnings limit.

How the Earnings Limit Is Applied

The about confusing part of the benefit reduction due to income is how information technology'south reflected in your monthly benefits deposits. Instead of taking out a little bit every month, the SSA will withhold several months of benefits at a time.

If you lot predict in advance that you lot will have excess earnings and report this to the Social Security Administration, they may take a few months of benefits before yous really earn the predictable backlog earnings.

For instance, if your Social Security payment is $1,667 per month, and you lot expect to receive $29,560 in wages from your job, the Assistants would calculate that you lot'll be over your earnings limit by $10,000 and thus $5,000 in benefits should exist withheld. So, they would withhold your benefit payment from Jan to March. In April, your checks would resume.

If y'all don't report excess income before you earn information technology, then you have to report this information later the fact. You tin do this when yous file your income revenue enhancement return, but the preferred method is to be proactive and call your local Social Security Administration function.

If y'all wait for the Social Security Administration to larn of your backlog earnings via your tax return, at that place could be a significant gap between the fourth dimension you earn the excess income and the time that they withhold your benefits. In virtually cases, it's better to report the excess earnings quickly so the benefits reduction occurs closer to the fourth dimension you lot actually earn that extra income.

Regardless of whether your benefits are withheld in advance or in arrears, benefits withholding can make budgeting and planning difficult, specially if yous don't understand the arrangement. Y'all may need to create a separate savings account to set some of those earnings aside to compensate for benefits withholding that will occur in the future.

What Kind of Income Counts every bit Earnings?

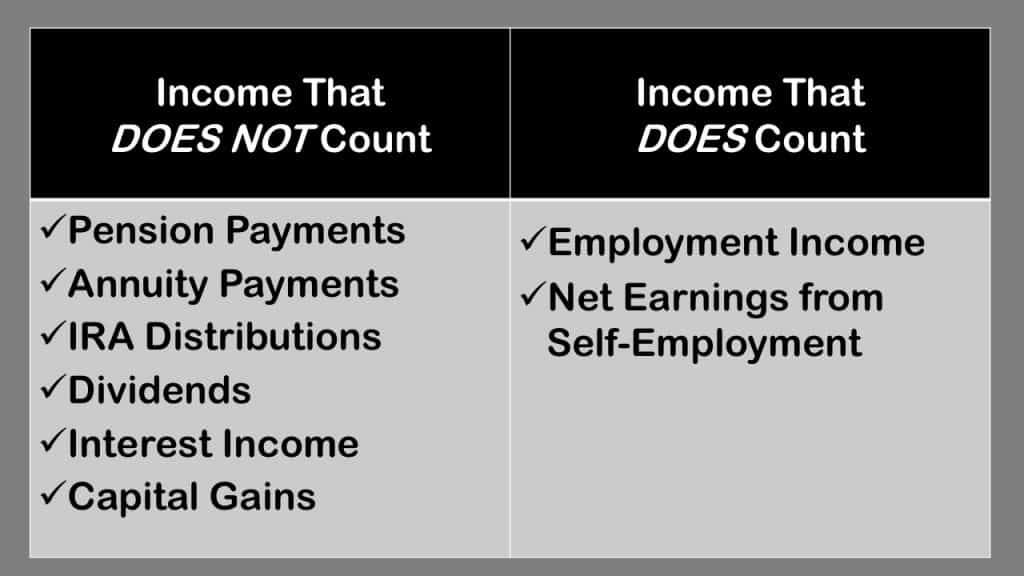

The Social Security income limit applies only to gross wages and net earnings from self-employment. All other income is exempt, including pensions, interest, annuities, IRA distributions and capital gains.

The term "wages" refers to your gross wages. This is the money that you earn before any deductions, including taxes, retirement contributions, or other deductions.

If you want to see a more in-depth conversation well-nigh what counts as income for the earnings limit, see my article on the Social Security Income Limit: What Counts as Income?

What to Do If Your Benefits Are Already Beingness Withheld

If you lot're subject to the Social Security earnings limit, don't wait for the SSA to start reducing the do good you receive. Instead, I'd recommend voluntarily suspending benefits.

If you wait for the Social Security Administration to discover that yous've earned likewise much working while receiving benefits, your risk of an overpayment notice is college.

Either mode, yous aren't missing payments that you'll never get back. Your do good amount will exist recalculated at your full retirement historic period (or when you stop working) to reflect the months that benefits were withheld.

The best way to avert the earnings limitation is to await until total retirement age to file for benefits. If yous tin't look, make sure you lot have a clear agreement of how working impacts your Social Security benefits.

If you lot still accept questions, you could get out a annotate beneath, merely what may be an even greater help is to join my Complimentary Facebook members group . It's very active and has some really smart people who dear to answer any questions you may have nearly Social Security. From time to time I'll even drop in to add my thoughts, likewise.

You should also consider joining the 365,000+ subscribers on my YouTube channel ! For visual learners (as most of us are), this is where I break down the complex rules and assistance you effigy out how to use them to your advantage.

One last thing that you don't want to miss: Exist sure to get your FREE copy of my Social Security Cheat Sheet . This handy guide takes all of the near of import rules from the massive Social Security website and condenses it all down to but one page.

Source: https://www.socialsecurityintelligence.com/social-security-income-limits/

Posted by: belangerawor1940.blogspot.com

0 Response to "What Is The Limit Of Earned Money That I Dont Need To Reporte In Nevada"

Post a Comment